Introduction: A Vision Fulfilled by the Modi Government

On August 15th, 2025, Prime Minister Narendra Modi addressed the nation from the Red Fort with a promise: to bring about Next Generation GST reforms that would directly relieve the tax burden on the common man, boost small businesses, and invigorate India’s economic growth. True to his word, within weeks, the Government announced sweeping changes that will reshape the nation’s tax landscape, simplify compliance, and bring substantial relief to millions. As PM Modi declared, this is a “Diwali gift” for every Indian family, with cheaper daily-use items and wide-reaching prosperity.

Table of Contents

-

What is GST 2.0? – The Next Generation Reform at a Glance

-

Why Was GST 2.0 Needed? The Vision Behind the Reform

-

Key Decisions at the GST Council Meeting on September 3, 2025

-

New GST Rate Structure (Product & Service List)

-

Merit Rate: 5% Slab

-

Standard Rate: 18% Slab

-

Sin/Luxury Rate: 40% Slab

-

Zero/Exempted GST Items

-

-

Major Exemptions & Citizen Benefits

-

Check the New GST Rate for Your Product/Service

-

Sectoral Impact: MSMEs, Startups, Everyday Consumers

-

Filing, Compliance, and Business Ease

-

FAQs on GST 2.0 (With Quick Links)

-

Downloadable 2025 GST Rate Chart

-

Conclusion: Transforming India for All

What is GST 2.0? – The Next Generation Reform at a Glance

GST 2.0 is India’s boldest tax reform since the launch of the Goods and Services Tax in 2017, fulfilling PM Modi’s pledge to make the system simpler, fairer, and more transparent. This second-generation reform slashes the number of tax slabs, clears classification disputes, and brings all states and sectors together to benefit every citizen—especially the middle class, MSMEs, women, and youth.pib+3

Key Dates:

-

Announced: August 15, 2025 (Independence Day speech)

-

Effective: September 22, 2025 (first day of Navratri and pre-Diwali)

Why Was GST 2.0 Needed? The Vision Behind the Reform

The first phase of GST, launched in 2017, radically shifted India’s complex indirect taxation to a unified system. However, real-world challenges—too many rate slabs, working capital blockages, and frequent disputes—remained.

After eight years, PM Modi’s government identified the need for a clearer, more equitable, and people-friendly system:

-

Reduce Cost of Living: Make essentials affordable for every household.

-

Boost Businesses: Simplified rates and refunds for MSMEs, start-ups, and traders.

-

End Disputes & Ambiguity: Fewer classifications, less litigation.

-

Strengthen Federal Cooperation: Wide consultation with states for truly cooperative federalism.

Key Decisions at the GST Council Meeting on September 3, 2025

Following the landmark announcement by Prime Minister Narendra Modi on August 15, 2025, the GST Council convened on September 3, 2025, to finalize and approve the pathbreaking reforms that would usher in the next generation of GST—GST 2.0. This Council meeting was a critical milestone in transitioning from promise to policy, where decisive actions brought clarity and consensus on major reform components.

The Council’s unanimous decisions included:

-

Two-Slab GST Rate Structure: Formal adoption of a simplified GST rate framework featuring a 5% merit rate for essential goods and services, an 18% standard rate for most consumer and industrial products, and a 40% demerit rate applicable to luxury and sin goods such as tobacco and high-end vehicles.

-

Substantial Rate Reductions: Approval of significant tax relief on several everyday items—including medicines, food products, insurance premiums, salons, gyms, and wellness services—making these more affordable for the common citizen.

-

Implementation Timeline: A firm commitment to roll out all GST 2.0 reforms starting September 22, 2025, thereby giving businesses and consumers a clear timeline to prepare for the changes.

-

Compliance and Transparency Measures: Initiatives to reduce disputes and ease filing, including procedural simplifications and automated return systems to support taxpayers and small-scale traders.

This meeting embodied the government’s dedication to fulfilling PM Modi’s vision of an equitable, transparent, and growth-oriented GST system, reinforcing India’s path toward economic prosperity and social welfare.

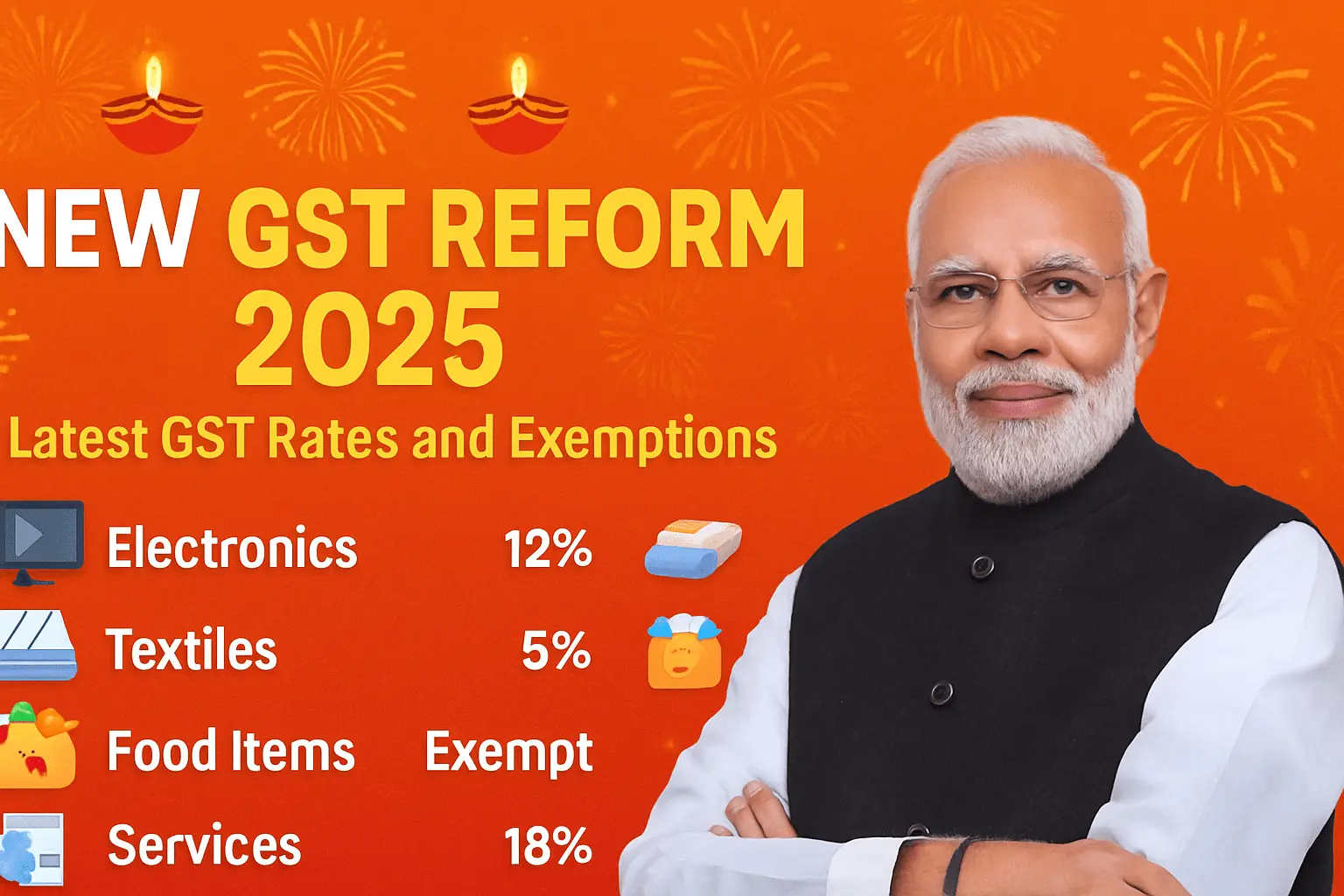

New GST Rate Structure (Product & Service List)

a) Merit Rate: 5% Slab

-

Daily essentials: UHT milk, paneer, bread, ghee, key medicines, most food items.

-

Lifestyle: Many beauty and wellness services (gyms, yoga, salons).

-

Select consumer goods: soap, detergents, writing instruments, and more.indiatoday+1

b) Standard Rate: 18% Slab

-

Bulk of manufactured/consumer goods and services: electronics, household appliances, standard groceries, auto (≤350cc), batteries, textiles, and footwear.

-

Service sector: tourism, hotels (standard category), digital services, logistics.

c) Sin/Luxury Rate: 40% Slab

-

Tobacco, pan masala, luxury cars, high-end consumer durables, and a restricted list of demerit items.indianexpress+1

d) Zero/Exempted GST Items

-

Health and life insurance (personal, term, endowment, family floater): 0%

-

Select life-saving drugs, dialysis consumables, agricultural implements, raw food grains.

-

Download the full updated 2025 GST rate list from the [official government portal].

Major Exemptions & Citizen Benefits

The Modi government’s reforms deliver direct benefits to common Indians:

-

Insurance Relief: No GST on individual health/life policies, easing household budgets.

-

Medicine Affordability: Over 33 critical medicines become cheaper or tax-free.

-

Daily Groceries Cheaper: Staple foods, bread, dairy, soaps, and essentials drop to 5% or 0%.

-

Entrepreneur/Small Business Support: Tax cuts and compliance simplification for MSMEs—India’s backbone.

-

Women and Youth: Consumer, beauty, and personal care products benefit from reduced rates.

Check the New GST Rate for Your Product/Service

Step-by-step guide:

-

Identify your product/service’s HSN/SAC code (provided by your vendor/invoice).

-

Access the Govt GST rate portal or download the 2025 PDF.

-

Search by code or product name.

-

For customised help, leave a comment on this post and our experts—or the StreamingWords community—will assist you.

Sectoral Impact: MSMEs, Startups, Everyday Consumers

For MSMEs & Startups:

-

Lower rates mean higher margins, more competitive pricing.

-

Correction of “inverted duty structure” unlocks working capital.

-

Refunds/processes are now automated and faster.

For Consumers:

-

Major drop in prices for daily-use goods/services.

-

More clarity and transparency while shopping.

For Nation:

-

Greater compliance, stronger economic activity, and price stability—a triple win as India moves towards developed-economy status by 2047 (PM Modi’s vision).

Filing, Compliance, and Business Ease

-

GST Return Simplification: Pre-filled forms, fewer fields, and real-time processing.

-

Quick Refunds: Exporters and manufacturers benefit from instant refund modules.

-

Small Traders: Business registration, compliance, and filing are now possible online and with less paperwork.

-

End of Compensation Cess: Except for sin goods, most sectors no longer need to worry about additional cess.

FAQs on GST 2.0 (With Quick Links)

Q1. Which products are tax-free under the new GST?

A: Health & life insurance, certain medicines, key daily essentials.

Q2. What is the GST on my business’s product?

A: Refer to the category-wise tables above or check the downloadable PDF by Taxonation.

Q3. When do these changes take effect?

A: Sept 22, 2025 (Navratri).

Q4. Who benefits most from GST 2.0?

A: Middle-class households, MSMEs, and rural markets.

Downloadable 2025 GST Rate Chart

Get our easy-to-use GST 2.0 rate table and product/service list-

-

Govt GST Rate Lookup Portal (external; for the latest, always verified rates)

Conclusion: A New Era of Ease and Prosperity Under PM Modi

The historic rollout of GST 2.0 stands as a testament to the Modi government’s foresight and its commitment to honest, citizen-centric governance. This sweeping reform honours the promise made by Prime Minister Modi on Independence Day: a “Diwali gift” for every Indian, with lower prices, simpler compliance, and a system that puts the needs of the people and the nation first.

From households and youth to MSMEs and entrepreneurs, GST 2.0 symbolises “ease of living, ease of doing business, and ease of dreaming big” for a new India. As the nation steps into an era of transparent growth and inclusive prosperity, the reforms of 2025 will be remembered as a transformative legacy of leadership and vision.

Have questions about GST on your product or service? Share them below—our experts and community are ready to help!

Jai Hind. Jai Bharat.