Record-keeping is one of the most important parts of payroll, but it comes with many challenges.

One of the best ways to enhance payroll record-keeping is to automate payroll. Payroll automation simplifies and streamlines record-keeping while saving your company time and keeping you compliant.

Let’s dive into how automated payroll helps record-keeping.

Payroll Records to Keep

Examples of records to keep on file for payroll include:

- employment dates

- employee ID number

- the dates and amounts of wages

- reported tips

- pension payments

- hours worked

- basis of payments (salary, hourly, etc.)

- overtime earnings

- time cards/ schedules

The Importance of Keeping Accurate Payroll Records

Record-keeping is a vital part of the payroll process. There are many crucial reasons to keep accurate payroll records, including:

- compliance: The IRS requires businesses to keep certain records for federal employment tax. Many states have their own requirements as well. Furthermore, the Fair Labor Standards Act requires certain records for compliance. Having these records stored (and accessible) ensures compliance and prevents fines from audits.

- performance monitoring: You need proper records to assess performance and productivity. Looking back at employee hours can help you assess performance. Payroll records overall help assess the productivity of the business.

- manage workload: Monitor employee hours to ensure a fair workload. This also helps plan future schedules (especially for holiday times).

- resolve disputes: Without proper records, you leave your company open to disputes. Records help resolve disputes between employees and employers. Records can focus on a variety of topics such as attendance, pay agreements, time off and more.

- Employee access: Accurate payroll records don’t just help employers. These records can also help employees. Employees need access to their records for tax purposes and personal finance planning.

Automate Payroll to Improve Record-Keeping

While record-keeping is incredibly important for companies, it can be quite difficult. You must keep track of a lot of payroll information. Furthermore, you have to hold onto records for several years to maintain compliance. Keeping the records is only part of the battle. If you have the records but can’t present them to the IRS, then they are not helpful.

As you can imagine, trying to keep track of these records manually is nearly impossible. Manual payroll records are time-consuming and error-prone. Instead, automate payroll to improve record-keeping.

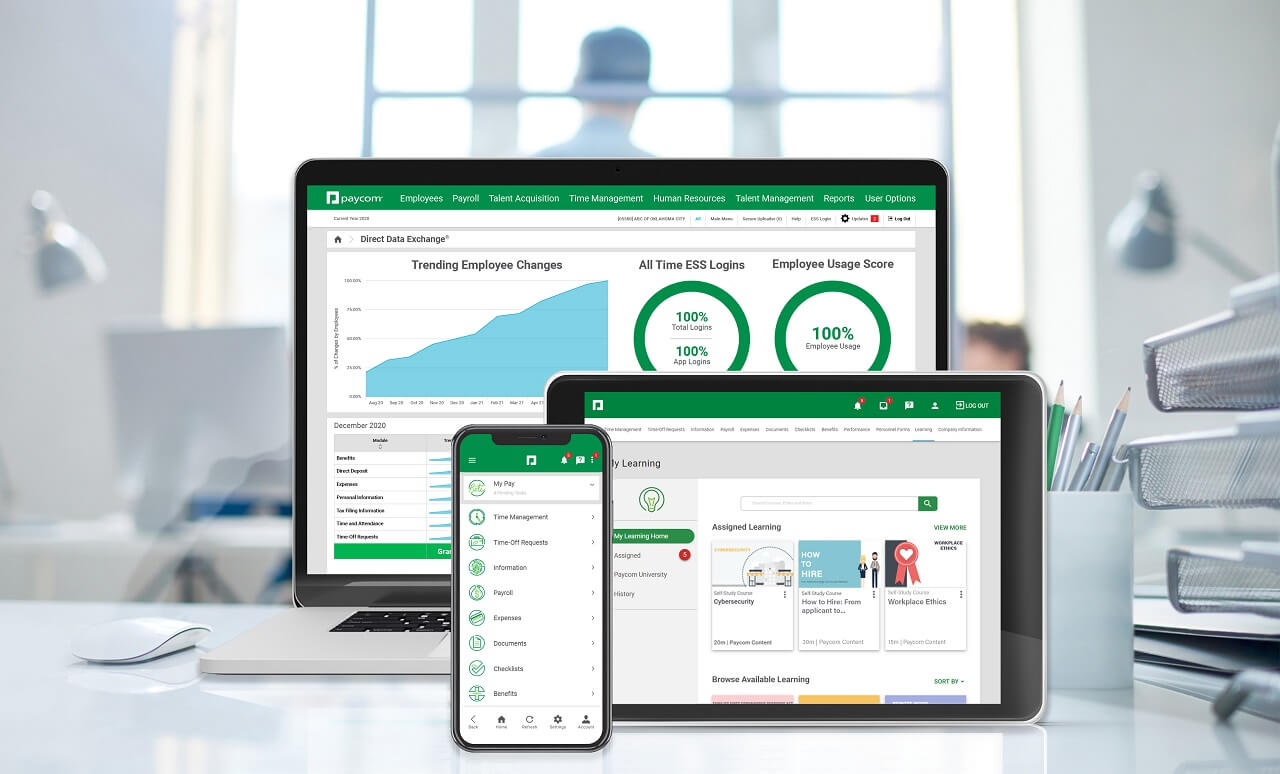

With automated payroll software, there’s no need for extensive manual record-keeping. The system automatically tracks and stores the necessary records. The well-organized records are easy to keep track of and access when you need them.

You can then use the automated payroll system to generate helpful reports based on the records. Instead of digging through all the records, you can quickly generate reports. The reports make it easier to assess labour costs, productivity, workloads and more.

Conclusion

To stay compliant and monitor performance, you need a robust payroll record-keeping system. Manually keeping records sets you up for a load of errors and frustration. When you automate payroll, you can also automate record-keeping. Payroll software automatically tracks and stores records, providing you (and your employees) with fast, easy access.