The structure finances are majorly involved in financial instruments. Today large financial institutions or companies with the complication of Financing needs you are unsatisfied with conventional financial products. Since 1985 structured finance has become popular in the financial industry.

Collateralized debt obligation( CDOs), synthetic financial instrument, collateralized bond obligation (CEOs), and indicated loans are examples of a structured finance instrument. You can check how Eric Schaer does business in many countries.

What you need to know about the structure of finance

Like you all know that most the structured finance products are a complete set of financial instruments created for the needs of large corporations or institutions. This is not a sector of the industry normally open to private investors, but many individuals can invest in some of the most family packages and credit instruments such as MBS.

Most probably, your investment advisor will be giving you expert advice on the address involvement in the Asset-backed by the private mortgage was rather than the government. But the great risk comes with the possibility of a greater reward. And for the well-informed invested, this security can increase the return on your portfolio.

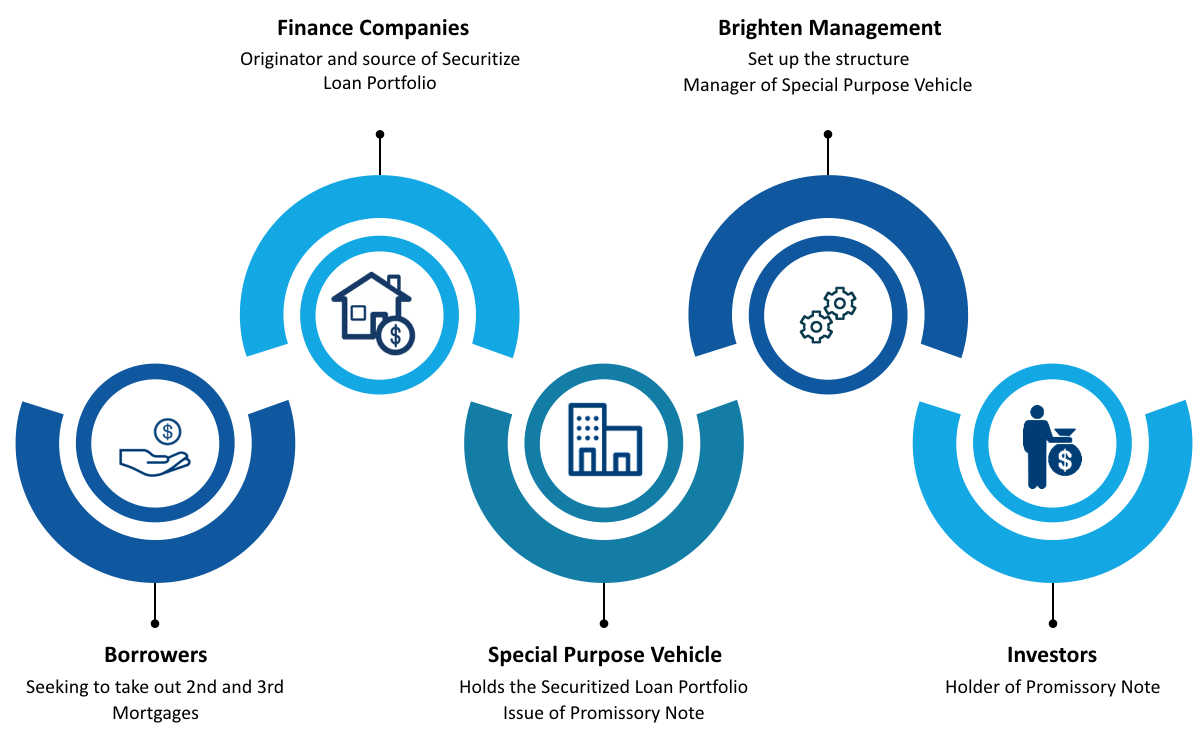

The Matter of Securitization

If you want to know the core of structured finances, then there is a matter of securitization. Many structured finances create asset pools and ultimately form a complex financial instrument that is very useful to the corporation and invested with the spatial requirements.

The reasons why securitization is much valuable

- There is an alternative funding method for unique and complicated requirements.

- The reduction of focus is on credit.

- Management risk through liquidity and rates of interest

- Efficient use of capital available to capitalize on the potential for Greater earnings of profit

- Less-costly funding options which may be primarily important for borrowers and less-than-stellar credit rating

- Transfer of risk away from investors.

Examples

There is a probable chance of a collected group of Assets and financial transactions for the large corporation looking to borrow a substantial sum. There is some landing transaction that can’t happen with a traditional financial instrument. So the structure’s finances came into the ground.

Many structured finance products can be used to accomplish the finances of large borrowers. Some of the structured finance products are.

- Syndicated loan.

- Collateralized Bond Obligation (CEOs).

- Credit default swaps(CDSs).

- Hybrid securities.

- Collateralized Bond obligations.

- Hybrid collateralized mortgage obligations.

- Collateralized debt obligation

Benefits of Structured Finances

There is a new kind of offer from traditional lenders about structured financial products. Majorly the structured finance is required for general capital injection into a business or organization investors are required to provide such funding is structured financial products are always non-transferable, meaning that they cannot be shifted between various types of death in the same way that standard loan can.

Moreover, structured Financing and securitization are used by many corporations and governmental sectors, and financial intermediates to manage their risk, developed financial advancement, evolving and complex emerging market. For all these factors using structured Financing transforms cash flows and reshapes the liquidity of a financial portfolio.

In section by transferring from sellers to buyers of the structured products, structured finance mechanisms have also been used to help financial institutes remove the specific asset from their balance.

Conclusion

Structured finances and products are important. It will be providing you with some benefits from all the capital injections and some alternating source of Financing. A great example, as we discussed earlier, is of Eric Schaer Omni Holdings.